- K/12

- Higher Education

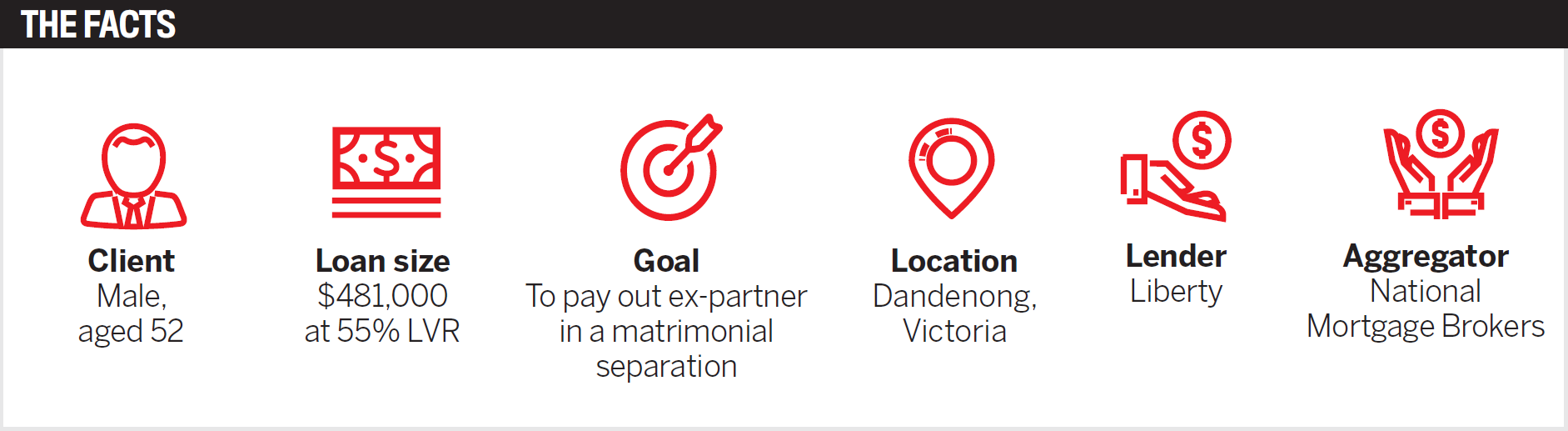

Andy Truong has nearly 15 years’ experience in banking and broking, and this year he switched aggregators to join nMB. He recently assisted a client whose existing lender couldn’t help when he needed to restructure his loans to keep his home.

The scenario

This client was in his early 50s and worked full-time as a blue-collar PAYG employee; he had been with the same empoyer for over 20 years. The client had an existing loan of $260,000 with a big four bank (that he had been with for many years) and had requested an increase to pay out an ex-partner. The bank had declined.

When the client came to us, he was stressed and very concerned that he might have to sell his home if he could not find a lender to assist him. Lenders being unwilling to assist existing borrowers is a common scenario we encounter. Putting myself in my client’s shoes, I fully understood how emotionally and mentally difficult it must have been for him, and the importance of finding a solution. We made it a priority to help him get out of this difficult situation so he could retain his home and work towards full ownership before he retired.

The solution

After we met with our client and completed a fact-find, we obtained the necessary documents to ensure that he could afford the increased debt level and that we could assist in identifying possible solutions. This process allows us to consider options to present to our client to achieve his immediate and future goals.

We knew the main challenge in this application would be the borrower’s age, ongoing child support payments and borrowing capacity. During my time as a lender at a major bank, and now as a broker, I have seen how important it is to correctly structure a loan scenario and provide detailed commentary. Tapping into my experience with these sorts of scenarios, we workshopped with several lenders as we needed to make sure we could mitigate any potential concerns.

After exploring a few options, it was clear that a number of lenders would have been unable to approve this scenario. After discussions with my nMB BDM Anthony Wick and my Liberty BDM Justin Kirby, I had full confidence Liberty could assist.

I had found previously that Liberty had been able to work on a wide range of loan scenarios, taking a more commercial approach and showing a willingness to help clients who didn’t fi t neatly into all the boxes.

Another key reason we have used Liberty in the past is that our BDM has a great working relationship with its credit team. This is crucial when we need to understand if there is appetite for a scenario being presented. It saves valuable time for my clients and, importantly, the broker.

Once we had completed the loan application with our client, we were able to address Liberty’s concerns in our loan submission. The application was lodged, and we received an approval in a few days for the full amount needed to refinance the existing loan and pay out the ex-partner.

The interest rate and fees were very good, not the lowest in the market but that was never expected to be the case. It was great to find a lender that was prepared to look at the whole situation and recognise the applicant’s strengths.

After delivering news of the approval, my client was so relieved. I could feel his happiness over the phone. Just a week earlier he had feared he would have to sell his home and start again, but he was now able to retain it, pay out his ex, and focus on moving forward.

The takeaways

I enjoy being a mortgage broker because our role is not just about getting a lower rate; more importantly, it is to help clients through challenging times by finding solutions to complex scenarios.

To deliver the best client experience and outcomes, we need the backing of – and a strong working relationship with – a broad range of lenders, as well as our aggregator nMB.

It’s important to maintain regular contact with lenders to keep relationships strong, and we commit to attending every product session. This helps brokers to remain solution-based.

When presenting a deal to a lender, always provide all necessary documentation and detailed notes.

Put yourself in the credit assessor’s shoes and provide the information you would like to receive.

Every client’s situation is different; always workshop the scenario across different lenders to ensure their policy, pricing and support will match the client’s needs.

Where you can, aim to provide a minimum of three options for the client to consider.